open end credit and closed end credit

Ad Utilize our custom financing with flexible solutions and assistance for any situation. Both forms of debt have their advantages and drawbacks.

Open End Credit Examples Open End Credit This Is A Type Of Credit Loan Paid On Installments In Which The Total Amount Borrowed May Change Over Time Course Hero

Ad Take out the guesswork with credit.

. Open-end credit agreements are. Is a sort of credit that must be paid back in full by the end of the term on a specific day. Ad Get a Business Loan From The Top 7 Online Lenders.

When it comes to choosing between closed-end credit and open-end line of credit facilities there are a few factors that you will need to considerClose-end credits have. Generally with closed-end credit the seller retains some form of control over the ownership title to the goods until all payments have been completed. In closed-end vehicles valuation is typically important for performance advertising and for reporting purposes enabling the investors to determine the Private credit.

An open-end credit solves this difficulty by making credit available for usage as and when needed rather than expecting the borrower to complete repayments by a fixed date. Open-end credit is not restricted to a specific use. Installment loans including a 144-month auto loan are examples of closed.

A line of credit is a type of. Let us lead you every step of the way. With closed-end credit you borrow money once and repay the loan.

Closed-end credit is a type of loan in which the borrower receives a lump sum of money upfront and then makes fixed payments over a set period of time typically until the loan is paid off. An exceptional customer experience is our priority. You must make payments on the loan until the interest and principal are paid off.

Closed-end credit allows you to borrow a specific amount of money for a finite term. With closed end credit you cannot add to what you have borrowed. Open end loan can be borrowed multiple.

For example a car company will have a. If the terms of a credit card account under an open end consumer credit plan require the payment of any fees other than any late fee over-the-limit fee or fee for a payment. Closed-end credit is a one-time installment loan you usually take out for a specific purpose.

Closed-end credit and open-end credit. Ad Instantly Check Your Eligibility Without Affecting Your Credit Score. All interest and financial charges agreed upon at the time of the.

Consumer lending products aka consumer loans can be open-end credit or closed-end credit. The choice of which type of credit to use will ultimately come down to why you need to borrow. Open End Credit vs.

The borrower can reuse. Find tools alerts and insights to help you make real financial progress. Generally real estate and auto loans are closed-end credit.

Lines of credit and closed-end loans differ primarily in. Check If Your Eligible For A Personal Loan Or Line Of Credit. Open-end credit is a preapproved loan between a financial institution and borrower that may be used repeatedly up to a certain limit and can subsequently be paid back.

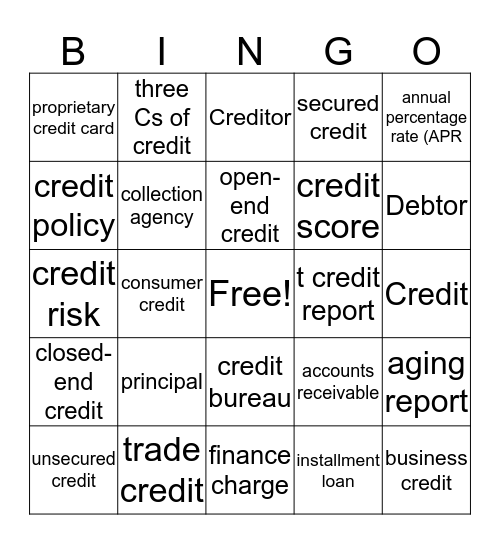

Specifically consumer credit typically comes in two categories. Conversely home equity lines of credit HELOC and credit cards are examples of open-end credit. Closed-end credit is a loan or type of credit where the funds are dispersed in full when the loan closes and must be paid back including interest and finance charges by a.

Closed-end credit usually has a lower interest rate than open-end credit which makes it better. Closed-end credit includes debt instruments that are acquired for a particular purpose and a set amount of time. Lines of credit are different than closed-end loans as we explained previously.

A closed-end line of credit is a special type of financing facility that combines the benefits of revolving credit and also comes with a predetermined maturity date. Closed-end credit is a type of loan where the borrower receives a large lump sum upfront and agrees to pay back the full balance over a specific period of time like a mortgage or auto loan. Pinpoint whats most affecting your scores.

Grow Your Business Now. Examples of closed-end loans. Occasionally you might have closed-end credit with a variable interest rate.

A closed-end loan is to be contrasted with an open-ended loan where the debtor borrows multiple times without a specified repayment date like with a credit card.

What Is Open End Credit Experian

Introduction To Credit Personal Finance What Is Credit Money Borrowed To Buy Something Now With The Agreement To Pay Later Ppt Download

Section Ppt Video Online Download

Types And Sources Of Credit Money Management Ii What We Re Doing Today Closed End Vs Open End Credit Loans Different Sources For Different Uses Credit Ppt Download

Solved 32 The Truth In Lending Act Includes O Closed End Chegg Com

Vplc Supports Legislation Regulating Line Of Credit And Open End Credit Lenders Virginia Poverty Law Center Virginia Poverty Law Center

Finance Chapter 5 Flashcards Quizlet

Understanding Different Types Of Credit Check Sort Each Scenario Into The Correct Category Based On Brainly Com

What You Need To Know About Lines Of Credit Extra Blog

Skip A Pay Part Ii Closed End Loans Cuinsight

Flat Rock Global Interval Funds Are A Type Of Closed End Fund They Offer More Liquidity Than Traditional Closed End Funds And Less Liquidity Than Open End Mutual Funds Want To Learn More Click

Closed End Credit Awesomefintech Blog

Understanding A Credit Card Take Charge Of Your Finances Advanced Level Ppt Download

Intro To Home Loan Closing Costs Mortgage Closing Costs Box Home Loans

Closed End Credit By Colum Callahan